Link Credit Card to PayPal: Easy Guide for PaymentsOh, hey there, guys! Ever found yourselves wondering how to make your online shopping and money transfers smoother, safer, and just plain easier? You’re not alone! A super common question many of us have is about

linking our credit card to PayPal

. It’s a fantastic way to streamline your digital transactions, whether you’re snagging that must-have item online, sending cash to a friend, or paying for services. This guide is all about demystifying the process of connecting your credit card to PayPal, making sure you understand the

ins and outs

of why it’s a smart move, how to do it step-by-step, and even how PayPal keeps your financial deets safe and sound. We’re going to dive deep, so grab a coffee, get comfy, and let’s unlock the power of seamless payments together. Trust me, once you’ve got this set up, your online life is going to feel a whole lot more convenient and secure. From understanding the core benefits of having a credit card on PayPal to navigating the actual linking process, we’ll cover everything you need. You’ll learn why this simple connection can be a game-changer for your digital wallet, offering layers of security and flexibility that traditional payment methods often lack. We’re talking about making your PayPal payments as effortless as a single tap, knowing that your credit card provides an excellent backup funding source for all your transactions. It’s not just about spending; it’s about smart spending and managing your money effectively in the digital age. So, let’s get this show on the road and transform your online payment experience from good to absolutely brilliant! It’s all about empowering you with the knowledge to make informed decisions and utilize the tools at your disposal to their fullest potential. Get ready to master the art of the hassle-free PayPal transaction, all powered by your trusty credit card. This comprehensive guide aims to equip you with all the necessary information, ensuring you feel confident and secure in every step you take. We’ll explore the various scenarios where

linking your credit card to PayPal

becomes incredibly advantageous, such as making quick purchases, managing subscriptions, or even handling international transactions with ease. The goal here is to provide you with a holistic understanding, transforming what might seem like a daunting technical task into a straightforward, empowering process. By the end of this article, you’ll be a pro at managing your credit card within the PayPal ecosystem, enjoying all the convenience and security it offers. Get ready to revolutionize your digital payment game, making every transaction smooth, secure, and stress-free. Let’s make your money work smarter for you, guys! # Why Link Your Credit Card to PayPal? The Ultimate ConvenienceAlright, so you might be thinking, “Why bother

linking my credit card to PayPal

when I can just use my card directly?” That’s a super valid question, and I’m here to tell you that there are some seriously compelling reasons why this connection is a game-changer, offering an

ultimate level of convenience and security

that’s hard to beat. First up, let’s talk

security

. This is arguably the biggest perk, guys. When you use your credit card directly on various websites, you’re constantly inputting your sensitive card details into different platforms. Each site then stores this information (hopefully securely!), increasing the potential points of vulnerability. But when you link your credit card to PayPal, you only give your card details to

one

trusted entity: PayPal itself. Then, when you shop online, you simply log into your PayPal account to complete the transaction, and PayPal handles the payment behind the scenes. The merchant never sees your credit card number, expiry date, or CVV. This

shields your financial information

like a digital superhero, drastically reducing the risk of your card details being compromised across multiple sites. It’s a huge win for your peace of mind! Beyond security, there’s the sheer

speed and simplicity

of PayPal payments. Imagine this: you’re at checkout, ready to buy, but you’ve left your wallet in another room. No problem! With your credit card linked to PayPal, all you need are your PayPal login credentials. No fumbling for cards, no typing out long numbers, just a quick login and a click. This makes for incredibly

fast and frictionless transactions

, saving you precious time and hassle, especially on mobile devices where typing can be a pain. It’s an absolute lifesaver for impulse buys or when you’re in a hurry. Then, let’s not forget

buyer protection

. PayPal is renowned for its robust buyer protection policies. If an item doesn’t arrive, or it’s not as described, PayPal often steps in to help resolve the issue and can even refund your money. This layer of protection is

in addition to

any buyer protection your credit card company might offer. So, by connecting your credit card to PayPal, you’re essentially getting

double the safety net

. It’s like having two sets of guardians watching over your purchases, ensuring you get what you paid for or your money back. What about

backup funding

? Sometimes, your bank account might be a bit low, or you might hit a daily debit card limit. With your credit card linked to PayPal, it acts as a secondary funding source. If your primary PayPal balance or linked bank account can’t cover a purchase, PayPal can automatically tap into your credit card, ensuring your transaction goes through without a hitch. This flexibility is

invaluable

for preventing declined payments and ensuring you can always make that important purchase or payment when you need to. Lastly, using PayPal can help you

manage your spending

. While it might seem counterintuitive with a credit card, by funneling all your online purchases through PayPal, you get a centralized record of your transactions. This can make budgeting and tracking your online expenditures much easier, helping you stay on top of your finances. Many credit cards also offer rewards points or cashback, and by using your linked card through PayPal, you still

earn those rewards

just as you would if you used the card directly. It’s a win-win situation, offering both enhanced security and continued benefits. So, in a nutshell, linking your credit card to PayPal isn’t just about convenience; it’s about upgrading your entire online payment experience with superior security, speed, protection, and flexibility. Trust me, once you experience it, you’ll wonder how you ever managed without it! # Step-by-Step: How to Seamlessly Connect Your Credit Card to PayPalAlright, guys, let’s get down to the nitty-gritty: the actual process of

how to link your credit card to PayPal

. Don’t worry, it’s not rocket science, and I’ll walk you through each step, making it as clear and straightforward as possible. You’ll have your credit card connected to your PayPal account in no time, ready for those sweet, secure online transactions. The whole goal here is to make sure your

PayPal payments

are as smooth as butter, and this is where it all begins. So, let’s dive into the practical side of things. First things first, you’ll need to

log in to your PayPal account

. Head over to the PayPal website or fire up the PayPal app on your smartphone. Enter your email address or phone number and your password. If you’ve got two-factor authentication enabled (which you absolutely should, by the way, for extra security!), you’ll need to complete that step too. Once you’re securely logged in, you’re looking for the ‘Wallet’ section. On the website, you’ll usually find this at the top of the page. In the app, it’s typically an icon at the bottom. The ‘Wallet’ is your digital hub for all things money-related in PayPal, including your bank accounts and, you guessed it, your cards. This is where the magic happens for connecting your credit card to PayPal. Now that you’re in the ‘Wallet’ section, you’ll see options to add a bank or card. Look for something like

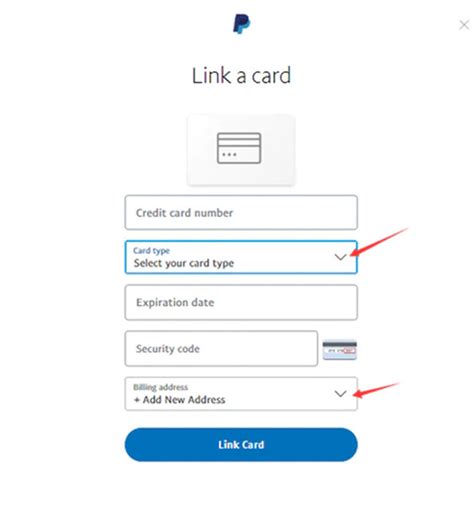

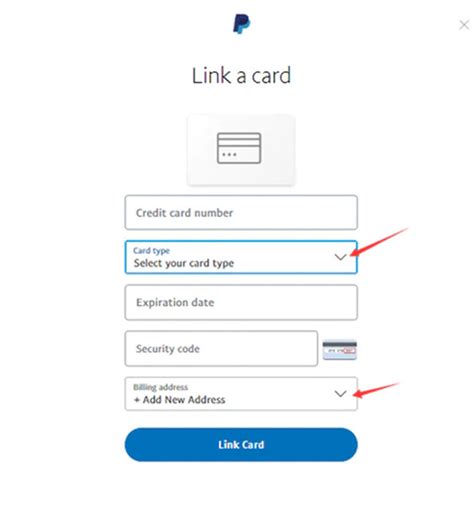

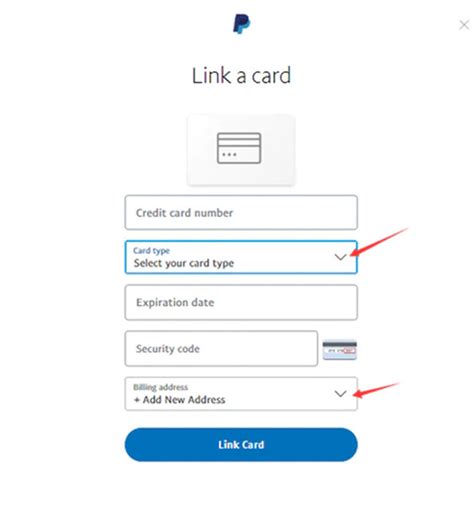

‘Link a Debit or Credit Card’

or just a simple ‘Link a Card’ button, often with a plus sign. Give that a click or a tap! This is your gateway to

adding your credit card to PayPal

. PayPal will then present you with a form to enter your credit card details. This is where you’ll need your physical credit card handy. You’ll be asked for: your

credit card number

(the long 16-digit number on the front), the

expiration date

(month and year), and the

security code

(CVV or CVC – usually a 3 or 4-digit number on the back of the card, near the signature strip). Make sure to double-check these numbers to avoid any typos, because even one wrong digit can prevent the card from linking successfully. Accuracy is key here, guys, so take your time! After you’ve meticulously entered all your card details, click or tap the

‘Link Card’

button. PayPal will then attempt to verify your card with your bank. This usually happens instantly. Sometimes, PayPal might make a small temporary charge to your card (like

\(1.00 or \)

1.95) to verify it’s active and belongs to you. This charge is

always refunded

to your card within a few business days, so don’t fret about it. It’s just a security measure to ensure you’re the legitimate cardholder. Once the verification is successful, congratulations! Your credit card is now officially

linked to your PayPal account

. PayPal will usually display a confirmation message, letting you know everything is good to go. You’ll then see your newly added card listed in your ‘Wallet’ section. From this point on, whenever you make a payment using PayPal, your credit card will be available as a funding option. You can even set it as your preferred payment method if you want. It’s that simple, guys! A few quick tips: If you encounter any issues, make sure your internet connection is stable, and double-check all the numbers you entered. If problems persist, it might be worth contacting your credit card issuer to ensure there aren’t any restrictions on your card for online linking, or reaching out to PayPal’s customer support. They’re usually pretty good at helping you troubleshoot. You’ve now unlocked a whole new level of convenience for your

PayPal payments

! # Understanding PayPal’s Security and Your Credit Card ProtectionWhen you’re

linking your credit card to PayPal

, it’s totally natural to have questions about security. I mean, we’re talking about your hard-earned money and sensitive financial information here, right? So, let’s clear the air and dive into how PayPal works tirelessly to keep your data safe and how your existing credit card protections still have your back. It’s all about creating a

secure PayPal payments

environment that gives you peace of mind with every transaction. First off, PayPal is a massive global financial technology company, and as such, they invest heavily in

top-tier encryption and fraud prevention technologies

. Think of it like this: when you enter your credit card details into PayPal, that information is immediately encrypted using advanced algorithms. This means that if anyone were to somehow intercept the data, it would be a scrambled mess, unreadable and unusable. PayPal uses

24

⁄

7

transaction monitoring, machine learning, and a team of security experts to detect and prevent suspicious activity. Their systems are constantly scanning for anything that looks out of the ordinary, whether it’s an unusual purchase location or a significantly higher-than-normal transaction amount. If something triggers their alerts, they might temporarily hold a transaction or reach out to you to verify it’s legitimate, which is a great extra layer of protection. So, when you

use your credit card with PayPal

, you’re not just relying on the security of the merchant’s website; you’re tapping into PayPal’s robust, dedicated security infrastructure. This significantly reduces your exposure to various online threats, as the merchant never directly handles or stores your credit card details. Your card number is safely tucked away within PayPal’s encrypted servers, only being shared with your bank to authorize a payment, and that communication is also highly secured. But wait, there’s more! What about your

credit card’s inherent protections

? This is where it gets really awesome, guys. When you

link your credit card to PayPal

, you don’t lose any of the fantastic fraud protection benefits your credit card company already offers. In fact, you essentially gain an

extra layer of security

. Credit card companies are well-known for their zero-liability policies, meaning if your card is used fraudulently, you typically aren’t responsible for the charges. This protection still applies even when your card is used through PayPal. So, if a payment goes awry or you spot an unauthorized transaction made via PayPal using your linked credit card, you have two avenues for recourse: you can go through PayPal’s dispute resolution process

and

you can contact your credit card issuer. This dual protection is incredibly powerful. PayPal’s

Buyer Protection policy

is another huge bonus. If an eligible item you bought online doesn’t arrive or isn’t as described, PayPal can help you get a full refund. This policy covers a vast majority of online purchases made with PayPal, and it works regardless of whether you funded the purchase with your PayPal balance, a linked bank account, or your linked credit card. It’s like having an extra safety net beneath your purchases, providing an added layer of confidence. In essence, by choosing to

connect your credit card to PayPal

, you’re not just enjoying convenience; you’re fortifying your financial security. You benefit from PayPal’s advanced fraud detection and encryption, plus all the powerful protections your credit card already offers. It’s a truly winning combination for anyone making

secure online payments

. Rest assured, PayPal is serious about security, and your credit card information is in good hands. So, go ahead and make those transactions with confidence, knowing you’re well-protected on multiple fronts! # Troubleshooting Common Issues When Linking Credit Cards to PayPalAlright, guys, even with the most straightforward processes, sometimes a little hiccup can occur, right? When you’re trying to

link your credit card to PayPal

, you might occasionally run into some snags. Don’t sweat it! These issues are often common, and with a bit of troubleshooting, we can usually get you back on track. Understanding these

PayPal credit card issues

is key to a smooth setup. Let’s tackle some of the most frequent problems and figure out how to solve them so you can get back to making

seamless PayPal payments

. One of the most common reasons a card won’t link is

incorrect card information

. I know, it sounds basic, but trust me, it happens to the best of us! A single wrong digit in your credit card number, an incorrect expiry date, or a mistyped CVV/CVC code (that 3 or 4-digit security code on the back) can cause the system to reject your card. Before you do anything else, go back and carefully re-enter all your card details. Seriously, double-check every number and letter. Is the expiration date correct (MM/YY)? Is the security code accurate? Even a small typo can lead to big frustration. Another frequent issue is when your

card is declined by your bank or issuer

. PayPal doesn’t actually decline your card; it’s your bank that does. This can happen for several reasons. Sometimes, for security purposes, banks might block an

online linking

attempt if it seems unusual, especially if you haven’t done it before or if it’s a new card. Your bank might also have temporary holds on your card, or you might have exceeded a daily transaction limit. To resolve this, your best bet is to

contact your credit card issuer directly

. Call the customer service number on the back of your card, explain that you’re trying to link your card to PayPal, and ask if they are seeing any declined transactions or blocks. They can usually clear it up for you in a jiffy. Then, try linking your card again. You might also encounter issues if your

card has an unsupported currency or type

. While PayPal supports a wide range of credit and debit cards (Visa, MasterCard, American Express, Discover), there might be specific card types or local cards that aren’t compatible. Additionally, if your card’s currency isn’t supported by PayPal or you’re trying to link a card from a country where PayPal doesn’t operate, you’ll run into problems. Make sure your card is one of the commonly accepted types and that it’s issued in a country where PayPal services are available. If you’re using a prepaid or gift card, sometimes these have restrictions on

where

and

how

they can be used, and may not be linkable to PayPal. Another potential headache could be

PayPal account limits or restrictions

. Occasionally, if your PayPal account is new or has some pending verification steps, there might be temporary limits on what you can do, including linking new cards. Make sure your PayPal account is fully verified, with all necessary identity checks completed. If you see any alerts or notifications in your PayPal account regarding limitations, address those first. PayPal might also have internal fraud prevention measures that flag certain linking attempts. In such cases, they might ask for additional verification. Finally, sometimes it’s just a

temporary technical glitch

on either PayPal’s side or your bank’s side. If you’ve checked everything else and are still having trouble, sometimes simply waiting an hour or two and trying again can magically fix the problem. You can also try clearing your browser’s cache and cookies or using a different browser or device (like the PayPal app instead of the website). If all else fails,

contact PayPal customer support

. They have dedicated teams that can look into specific error messages or account-related issues. Provide them with as much detail as possible about the problem you’re encountering, including any error codes you receive. Don’t let these

linking card problems

get you down! Most of the time, they’re easily fixable with a little patience and the right approach. Now you’re equipped to handle common

PayPal errors

and get your credit card successfully linked, ready for all your online payments! # Maximizing Your PayPal Experience: Tips for Using Linked Credit CardsAlright, guys, you’ve successfully navigated the process of

linking your credit card to PayPal

. Awesome! But the journey doesn’t end there. Now it’s time to talk about how you can truly

maximize your PayPal experience

by smartly using those linked credit cards. It’s not just about having them there; it’s about making them work best for you, ensuring every

PayPal payment

is as efficient and beneficial as possible. Let’s dive into some pro tips to help you get the most out of your setup. First up, if you have multiple credit cards linked, you can easily

manage your preferred payment method

. PayPal allows you to select a primary way to pay. This means when you make a purchase, PayPal will default to that specific card or your PayPal balance. This is super handy if you want to prioritize a particular card for its rewards, cashback, or to keep spending on a certain card organized. To do this, simply head back to your ‘Wallet’ section in PayPal, click on the credit card you want to set as preferred, and you should see an option to ‘Set as preferred’. This small tweak can save you a click or two during checkout and ensures you’re always using the card you intend to, whether it’s for earning points on travel or simply managing your monthly budget. Speaking of rewards, remember that using your

linked credit card through PayPal

generally means you still

earn all your usual credit card rewards

! Whether it’s cashback, airline miles, or points for specific categories, your credit card issuer typically treats PayPal transactions the same as direct card purchases. This is a huge advantage, as it means you’re not missing out on those valuable perks by using PayPal for enhanced security and convenience. So, keep an eye on your card’s reward categories and use the appropriate linked card to rack up those benefits! This strategy is crucial for

best way to use PayPal

for those who are reward-savvy. Next, consider using PayPal with your linked credit cards for

recurring payments and subscriptions

. Many services, from streaming platforms to software subscriptions, offer PayPal as a payment option. By linking your credit card, you can set up these recurring payments via PayPal. This adds an extra layer of control and often makes managing subscriptions easier, as you can see them all in one place within your PayPal account. If a card expires or you need to switch funding sources, you can update it once in PayPal, and it often propagates to all your linked subscriptions, saving you the hassle of updating each service individually. This feature alone makes

managing credit cards on PayPal

incredibly convenient. For those who dabble in

international transactions

, using PayPal with a linked credit card can be a game-changer. PayPal handles the currency conversion for you, and while there are fees, it can often be simpler and sometimes more transparent than direct international card transactions, depending on your card issuer. Always check PayPal’s exchange rates and fees before confirming an international payment, but it’s definitely an option worth exploring for global purchases. Another useful tip is to regularly

review your PayPal transaction history

. This isn’t just for budgeting; it’s a great way to monitor for any unauthorized activity. Since all your

PayPal payments

using your linked credit cards will appear here, it’s a centralized place to keep tabs on your spending and quickly spot anything suspicious. This proactive approach complements PayPal’s fraud protection and your credit card’s security measures, giving you maximum oversight. Finally, always ensure your

PayPal account details are up-to-date

, including your email, phone number, and security questions. A well-maintained account is a secure account, and it helps PayPal communicate with you quickly if there are any issues with your linked credit cards or transactions. By following these

PayPal tips

, you’re not just using PayPal; you’re mastering it. Your linked credit cards become powerful tools within the PayPal ecosystem, offering unparalleled convenience, security, and benefits for all your online financial needs. Enjoy the smooth ride, guys!In conclusion, guys, mastering the art of

linking your credit card to PayPal

is more than just a simple technical step; it’s about unlocking a world of enhanced convenience, robust security, and unparalleled flexibility for all your online payments. We’ve journeyed through the compelling reasons why this connection is a smart move, from the ironclad security PayPal offers to the invaluable buyer protection and the sheer speed of transactions. You’ve also gained a clear, step-by-step guide on how to seamlessly add your credit card to your PayPal account, ensuring you’re ready for any online purchase or money transfer. We’ve also armed you with the knowledge to troubleshoot common hiccups and, most importantly, given you a roadmap to

maximize your PayPal experience

with your linked cards, ensuring you’re always getting the most out of every transaction. Remember, your linked credit card isn’t just a funding source; it’s a strategic tool that, when combined with PayPal, creates a powerhouse of secure and efficient online financial management. So, go forth and make those

PayPal payments

with confidence, knowing you’re well-equipped to handle anything the digital world throws your way. Happy shopping and secure sending!